📘 1. Introduction: Why Roth IRA Is a Game-Changer in 2025

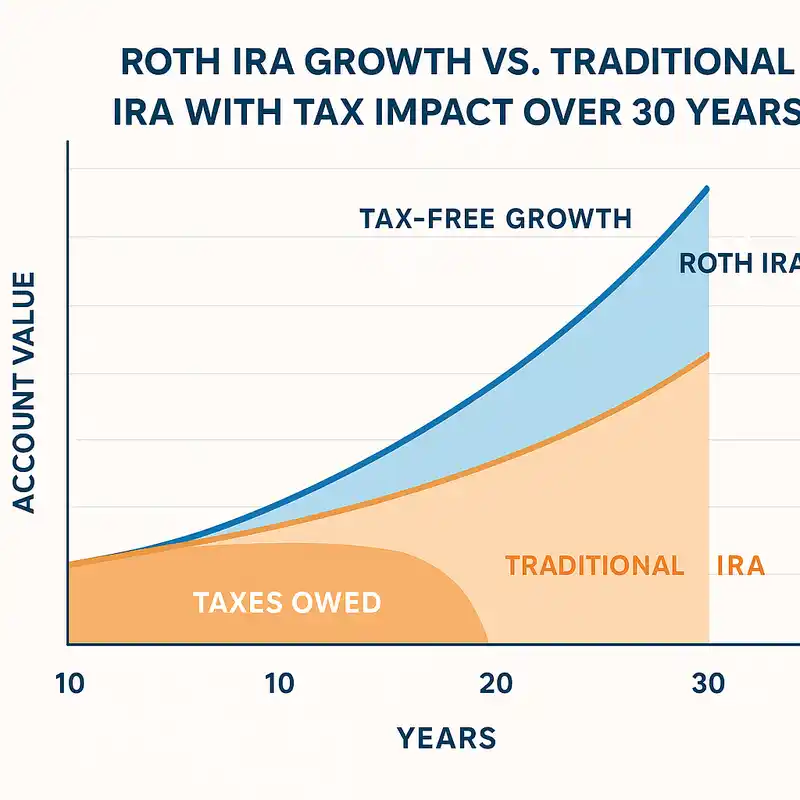

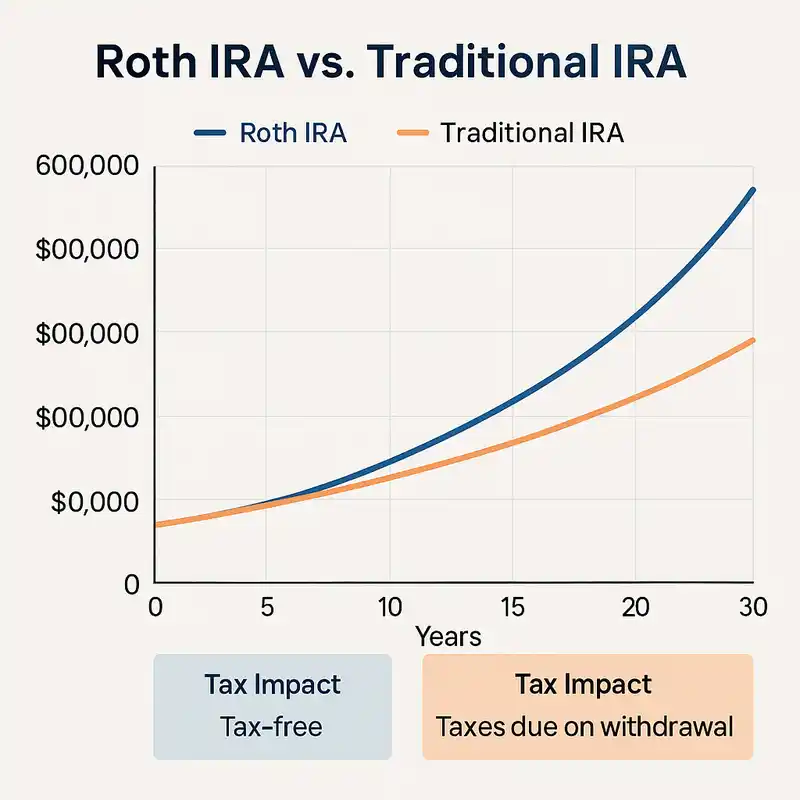

In 2025, inflation concerns, market volatility, and increasing skepticism about future tax rates make Roth IRAs more valuable than ever. With tax-free withdrawals and zero RMDs (Required Minimum Distributions), Roth accounts provide flexibility, legacy planning benefits, and long-term growth potential.

💼 2. The Basics of a Roth IRA

A Roth IRA allows you to contribute after-tax income today and withdraw earnings tax-free in retirement. In 2025, the annual contribution limit is $7,000 (or $8,000 for those aged 50+), and the income limit for full contribution eligibility is $146,000 for individuals and $230,000 for married couples filing jointly.

🕳️ 3. What Are Roth IRA Loopholes?

Loopholes aren’t shady or illegal. They’re legal strategies that help you maximize your Roth IRA benefits, even if you exceed income limits or want to shelter more income than standard rules allow.

🔄 4. The Backdoor Roth IRA Strategy

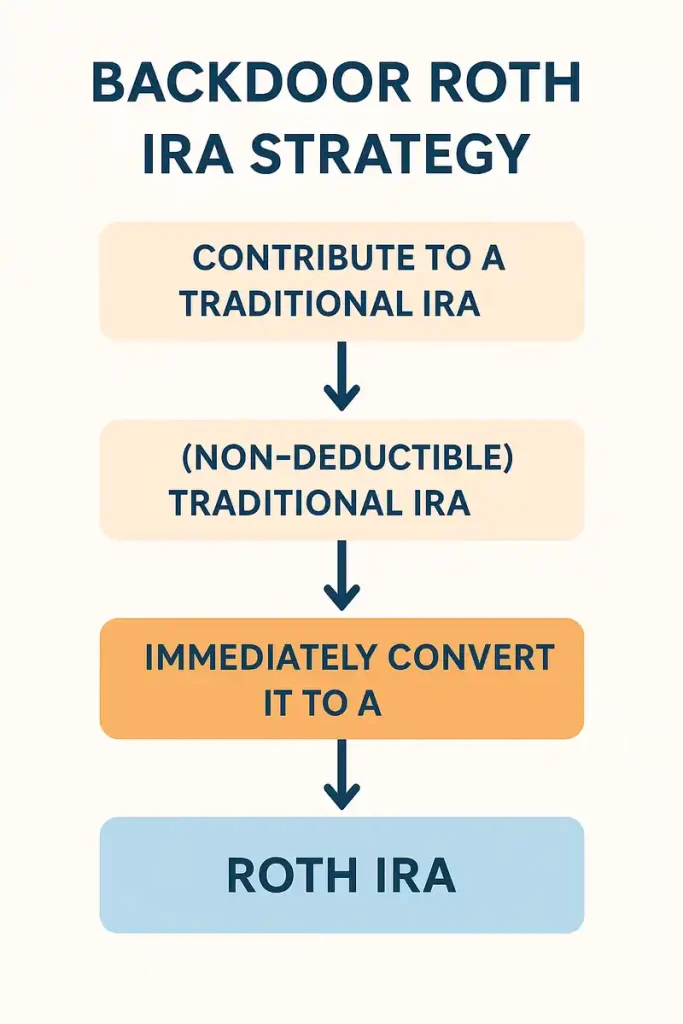

The most common Roth IRA loophole. If your income is too high to contribute directly, you can:

- Contribute to a Traditional IRA (non-deductible).

- Immediately convert it to a Roth IRA.

🏗️ 5. The Mega Backdoor Roth IRA

For high-income earners with access to a 401(k) that allows after-tax contributions and in-service withdrawals:

- Contribute up to $66,000 in total (employee + employer + after-tax).

- Roll the after-tax portion into a Roth IRA or Roth 401(k).

This can shelter tens of thousands more than the standard Roth IRA limit — completely legally.

🧾 6. Income Limit Circumvention

Aside from backdoor strategies, some investors reduce their Modified Adjusted Gross Income (MAGI) through:

- Health Savings Account (HSA) contributions

- 401(k) deferrals

- Business expense deductions

- Tax-loss harvesting

This helps them qualify for direct Roth contributions.

🔁 7. Rollover Loopholes: Timing and Tax Tricks

If you roll over funds from a 401(k) to a Roth IRA, you pay taxes on the pre-tax amount. However:

- Doing this in a down market minimizes tax.

- Spread conversions across multiple years to stay in lower tax brackets.

This strategic timing can save thousands in taxes.

🧠 8. Self-Directed Roth IRAs and Alternative Investments

With a Self-Directed Roth IRA (SDIRA), you can invest in:

- Real estate

- Crypto

- Private equity

- Tax liens

These asset classes, if managed properly, grow 100% tax-free.

📉 9. Roth Conversions in Market Dips

When the market drops:

- Your account balance is lower.

- So are the taxes on conversions.

This creates an opportunity to convert more assets for less tax and benefit when markets recover.

🔄 10. Strategic Use of Contributions vs. Conversions

Many people mix up contributions (after-tax money) and conversions (pre-tax money moved into a Roth). In 2025, prioritize:

- Contributions if under the income limit.

- Conversions when market conditions or tax brackets are favorable.

👶 11. Roth IRA for Children (Minor Accounts)

If your child has earned income (even from babysitting or modeling), you can help them start a Custodial Roth IRA. With decades of compounding, even a few thousand dollars can turn into millions.

💍 12. Utilizing Spousal Roth IRAs

Even if your spouse doesn’t work, you can contribute to a Spousal Roth IRA as long as you have earned income. This essentially doubles your household’s tax-free retirement savings.

🕓 13. Catch-Up Contributions and Age-Based Strategies

If you’re 50+, you can contribute an extra $1,000 annually. Combined with conversion strategies, this allows older investors to maximize tax-free balances before retirement.

Also:

- After 59½, you can withdraw contributions and earnings tax-free.

- Roth IRAs have no RMDs unlike Traditional IRAs, allowing better control over withdrawal timing.

⚖️ 14. Estate Planning with Roth IRAs

Roth IRAs pass to beneficiaries income tax-free. In 2025:

- Spouses can treat the inherited Roth as their own.

- Non-spouse beneficiaries must withdraw funds within 10 years, but withdrawals remain tax-free.

It’s an excellent wealth transfer tool.

⚠️ 15. Avoiding Common Roth IRA Mistakes in 2025

- Ignoring the pro-rata rule during backdoor Roths.

- Missing contribution deadlines.

- Over-contributing beyond limits.

- Assuming tax-free treatment without 5-year rule eligibility.

🔮 16. Upcoming Changes to Watch in 2026

The 2017 Tax Cuts and Jobs Act is set to expire in 2026. This may lead to:

- Higher income taxes

- Lower Roth conversion efficiency

- Possible changes to contribution limits or withdrawal rules

2025 is likely your last year to exploit current Roth loopholes at today’s rates.

🧭 17. Final Thoughts: Playing It Smart and Legal

Roth IRAs continue to be one of the most powerful tax-sheltered investment tools in 2025. Loopholes — when used strategically and legally — can significantly boost your wealth and retirement security.

Work with a tax advisor or financial planner to customize your Roth strategy based on income, age, goals, and market timing. The rules are complex — but the rewards are worth it.